Important Notes:

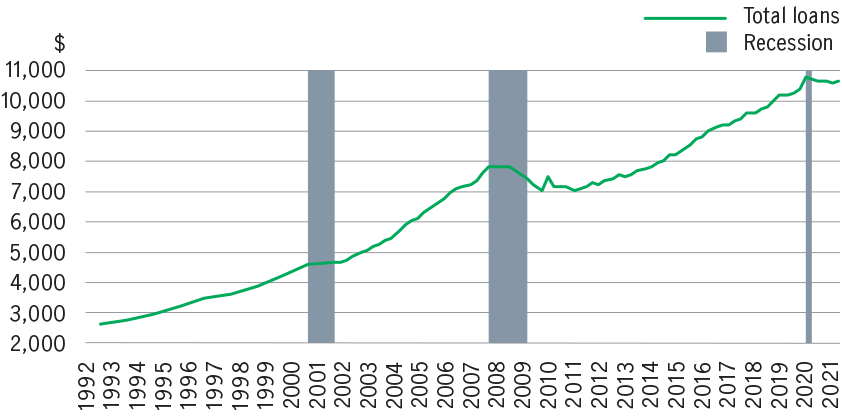

With a much-improved credit environment since the outbreak of COVID-19, growth momentum has accelerated in the US banking sector. In fact, we think a multistage bank recovery is already under way. We believe that continued economic recovery from the pandemic downturn clearly will support banks’ fundamentals, and there is upside potential to earnings estimates if the economy continues to improve given the revenue rebound through higher loan growth and higher rates in the years ahead.

As the economic rebound gains momentum and government stimulus programs wind down, we expect loan demand to accelerate. A potential uptick in lending would drive net interest income higher, fueling the revenue rebound, while a more normalized interest-rate environment would provide an additional catalyst.

US banking industry: Total loans (USD billions)1

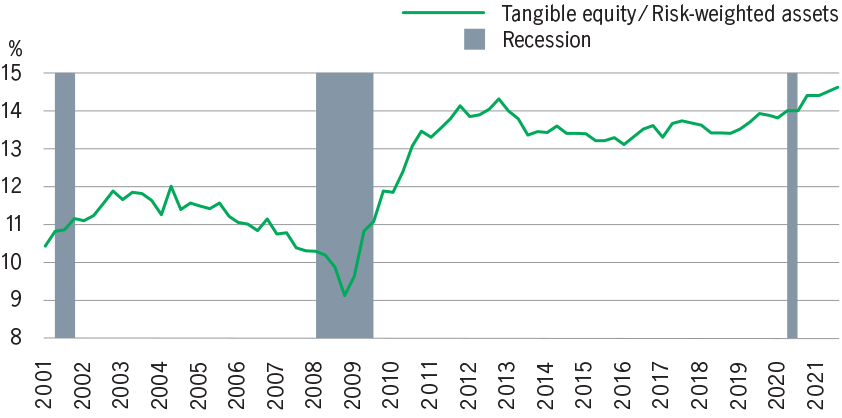

Higher excess capital enables higher capital returns to shareholders through dividend payouts, share buybacks and M&As.

US banking industry: Excess capital levels2

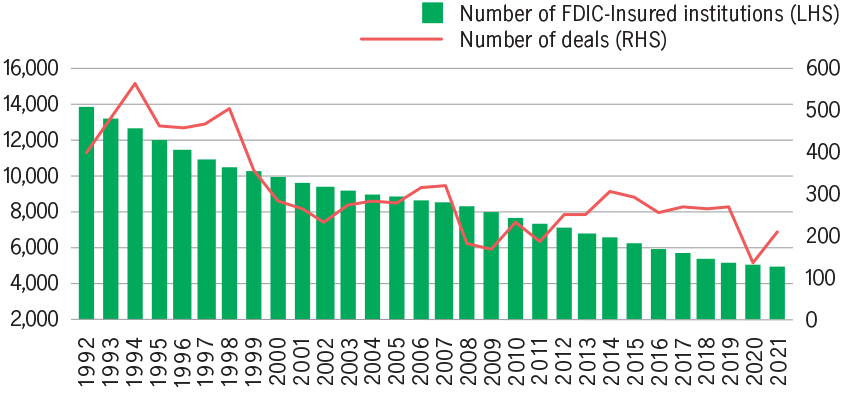

We believe the current environment is conducive to M&A activity. The consolidations not only unleashed values of the acquired banks, with a direct impact on boosting stock prices, but also create synergies to the acquiring bank with a sizable reduction in operating costs.

US banks: continued consolidation3

US banking industry valuation is trading at a meaningful discount to its historical average today, with potential for higher returns and multiple expansion. We believe that attractive valuations and the industry’s compounding book value provide a favorable entry point for long-term investors.

US banking industry: Price-to-Book Ratio4

Experienced team with boutique structure

Time-and market-tested research process

26+ years

Average experience of

portfolio managers

80% of assets6

Substantially invested

in regional banks

600+

Investment

professionals7

517366