Important Notes:

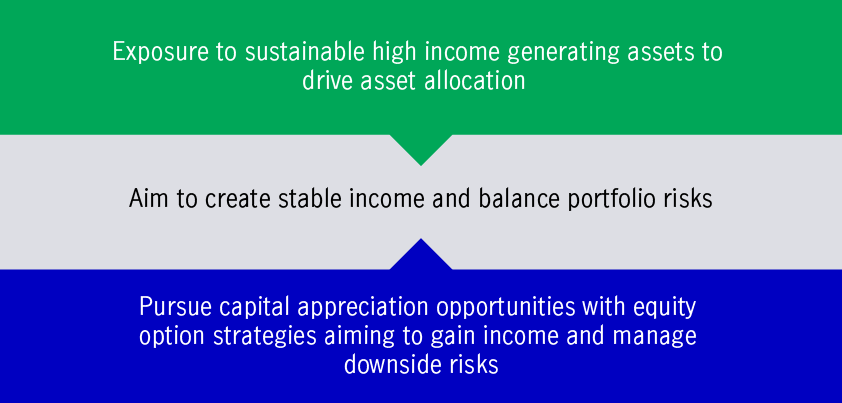

An unconstrained income driven approach across global asset classes can become an attractive strategy in order to capture a sustainable high-income payout within a challenged growth outlook.

To strive for a sustainable long-term income distribution, our strategy adopts a differentiated approach of achieving yield, minimising reliance on equity appreciation – primarily seeking yield through fixed income and an option writing strategy.

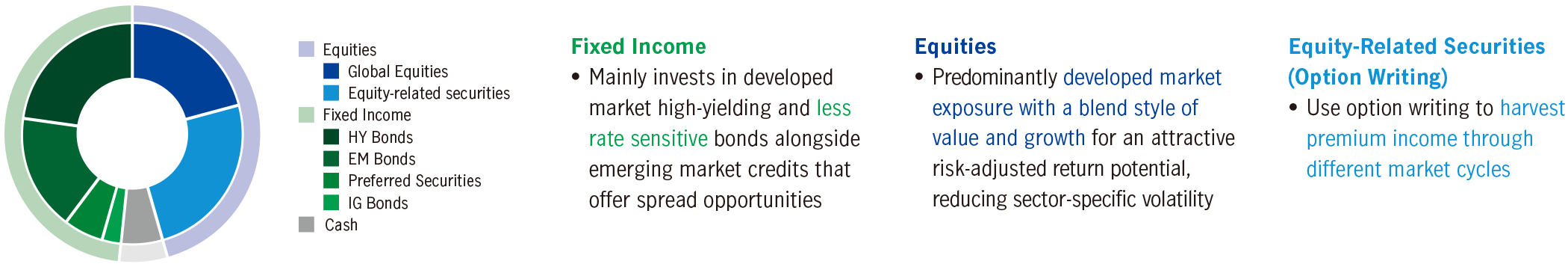

The typical asset allocation of the portfolio has a relatively low volatility profile, dominated by fixed income credits, low beta equities and an option writing (income generating) structure.

Typical asset allocation (%)1

Fixed income

Equity and equity related securities

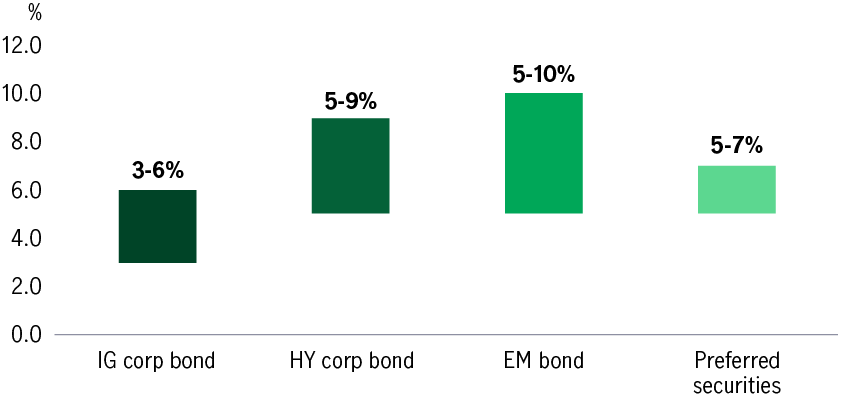

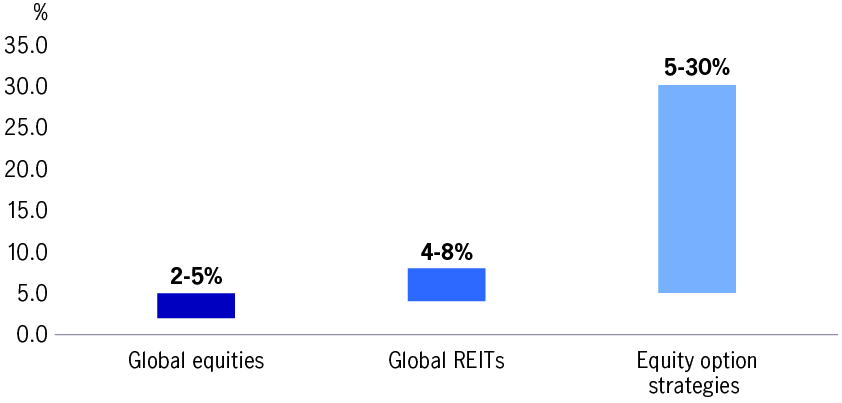

For a sustainable long-term income strategy, we strive to achieve higher natural yields (the cash generated from invested income sources) in order to minimise the need to rely on drawing from capital gains or principal capital.

Average yield breakdown by asset class (%)1

The tactical use of option-writing is key to our global multi-asset diversified income approach as it may provide a steady income stream potential in both up and down markets.

Option premium collected tends to increase with market volatility, which should be particularly rewarding during periods of market drawdown, when capital payout capabilities may be hampered.

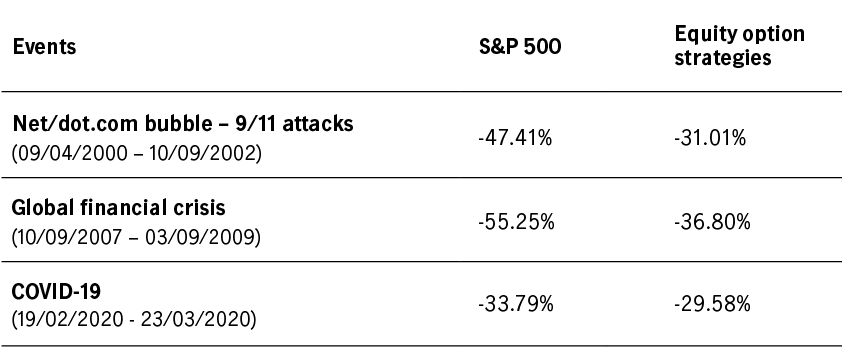

Historical data shows that equity option strategies saw shallower drawdowns than the broad equity market during several market corrections since 2000.

Performance during market volatility2

Aims to generate high, stable income through multiple traditional and non-traditional income sources.

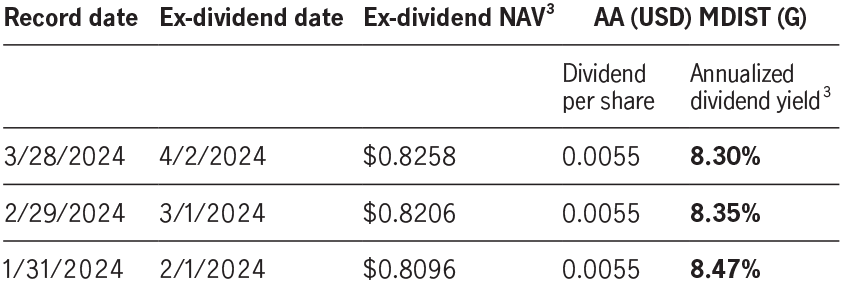

Dividend schedule

(The distribution yield is not guaranteed. Distribution may be paid out of capital. Refer to Important Note 2.)

*Applicable to AA (USD) MDIST (G) Share class. A positive distribution yield does not imply a positive return.

We are the global wealth and asset management segment of Manulife Financial Corporation, we draw on more than 150 years of financial stewardship to partner our clients globally.

25+ years

average investment experience of management team

625+

investment experts across asset classes4

USD 142.1 billion

AUM of multi-asset solutions5

2617819