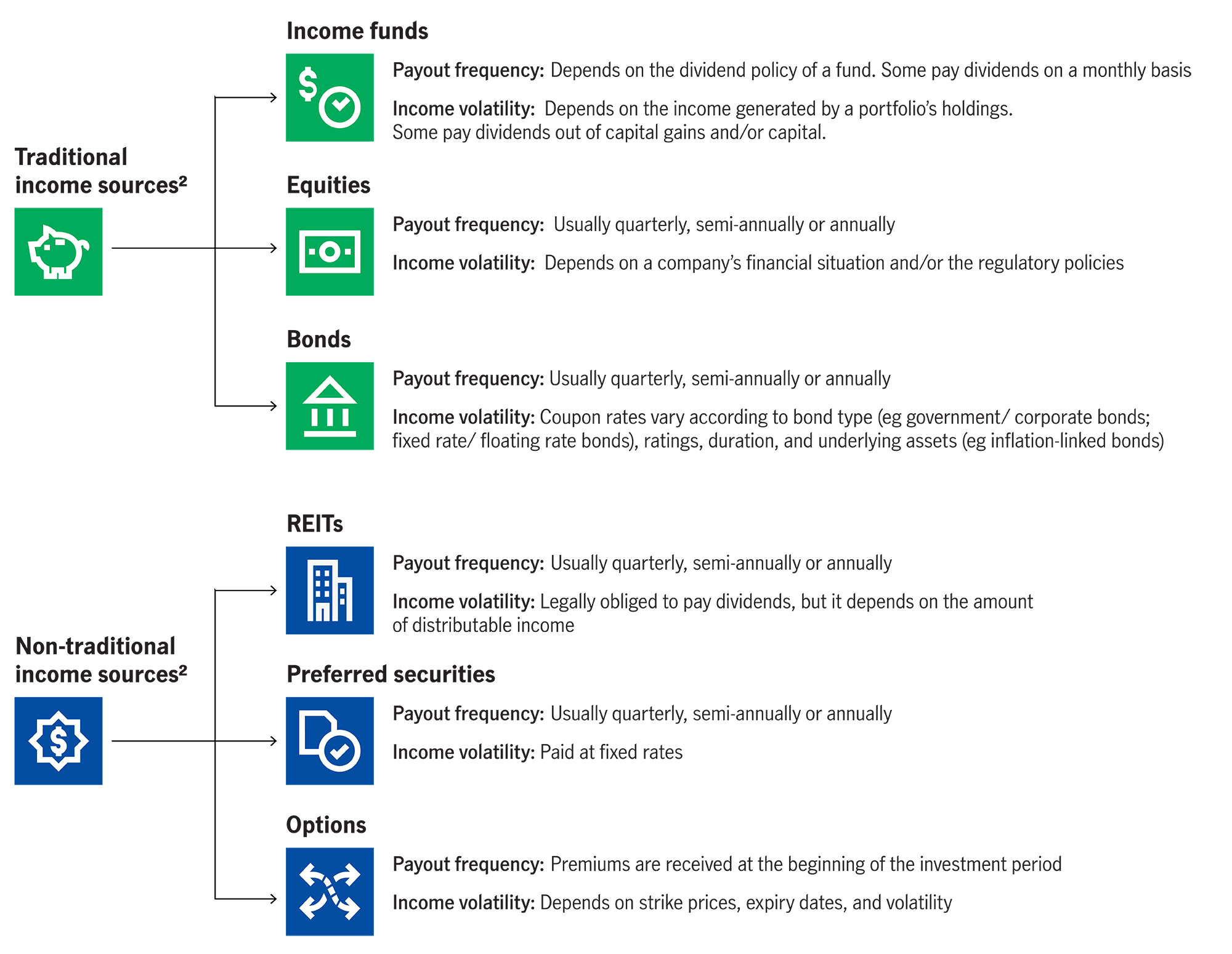

There are many income sources to consider, each with different characteristics such as income volatility and risk levels. By gaining an in-depth knowledge of these, investors should be able to find suitable options to broaden their investment income.

Income funds: These are mutual funds with payout characteristics that typically distribute dividends at regular intervals. Generally, the dividend yield is not guaranteed, but as is the case with any diversified portfolio, the likelihood of every holding simultaneously failing to distribute is small. In addition, the fund manager is allowed to pay dividends by profit-taking (capital gains), or even out of the capital. Therefore, the chance for investors receiving no income is relatively low.

Real Estate Investment Trusts (REITs): REITs are legally obliged to distribute the majority of net income after tax as dividends. They cannot suspend payouts due to economic or business factors. As long as a REIT records positive net income, unit holders are entitled to dividend payouts.

Preferred securities: Preferred securities are hybrid securities with equity and bond characteristics. They are usually issued by large, tightly regulated institutions and companies, such as banks or utilities. The dividend yield is generally fixed. These entities typically have larger and more stable cash flows, enabling them to pay dividends. Their default rate is also lower than that of high-yield bonds.

Options: By selling a call option or put option, investors can receive a premium (income) in advance without waiting until the option expiry date. However, it should be noted that obtaining a premium does not necessarily mean that the overall investment return is positive. If the trend of the underlying asset deviates from expectations, i.e., the price of an asset actually rises after selling a call option, or vice versa, overall returns may be negative, as the premium may not be adequate to offset the loss on exercising an option completely.

(Income Series, Part 2 of 3)

Click here to discover the importance of income investing.

Click here and learn how to include income tools in your asset allocation.

1 Source: Default rate of global high-yield bonds and global investment-grade bonds provided by Moody's Investors Service, Inc. Default rate of preferred securities during 1990–2017 calculated by Wells Fargo. As Wells Fargo stopped providing the relevant information after 2017, Manulife Asset Management has calculated the annual default rate based on the ICE BofAML US All Capital Securities Index since 2018. As of 31 December, 2019. Past performance is not indicative of future performance.

2 The above material is for illustration purposes only. Distribution of dividends, the frequency of distribution and the amount/rate of dividends are not guaranteed. Positive distribution yield does not imply positive return.

Hong Kong/Mainland China market update

Despite the market fall, we believe that the China Q4 2023 GDP growth trend has already been priced into the index, with some bright spots being neglected. Mainland China’s four mega trends (i.e., the “4As”) remain intact as better-than-expected inventory destocking and increased policy measures suggest a potential bottoming of the economy.

India’s bond index inclusion: Attracting foreign investment; bolstering its regional position

Indian government bonds would be included in the JPMorgan Government Bond Index-Emerging Markets (GBI-EM) Global index suite starting in June 2024. We examine the short- and long-term implications of this significant decision for the Indian bond market.

Index inclusion reinforces India’s transition to its next stage of growth

We explain how India’s impending inclusion in the JPMorgan Government Bond Index- Emerging Markets (GBI-EM) index should lead to an increase in global inflows.

How much do you know about rates?

Recognise the different terms related to interest rates and understand how much yield global government bonds can offer.

Four essential keywords related to interest rates

Central banks in some emerging and Asian markets have started to hike rates, but deposit rates may not necessarily move in tandem. This would gradually erode depositors’ purchasing power in an inflationary environment. To achieve potential returns that beat inflation, deposit-focused investors should base any investment decisions on their risk tolerance levels and wealth management objectives.

Why demographic change requires a new set of cards

Many Asian governments are considering incentives to encourage larger families. These evolving policies will be vitally important, as the region looks to sustain a fast-greying population.