7 January 2022

Hui-Min Ng, Portfolio Manager, Equities

Asia-Pacific REITs (AP-REITs) continued to show resilience in 2021, as regional markets gradually reopened, albeit at different speeds. Meanwhile, all economies emerged from technical recession. In tandem with the Asia real estate sector, dividend income also continued to recover strongly. In this 2022 outlook, Hui-Min Ng, Portfolio Manager, outlines why although uncertainty exists, especially with the emergence of the Omicron variant, the fundamentals of this asset class remain strong, and it is poised for continued rebound in 2022.

AP-REITs rebounded in 2021 after a difficult 2020. Regional economies re-opened at different speeds, as mobility and travel restrictions were gradually reduced. And given continued robust fiscal and monetary policies, all regional economies were able to come out of recession.

The situation in Hong Kong has improved due to tight border controls, and tenant sales have shown a healthy recovery boosted by the issue of consumption vouchers. In Singapore, a high vaccination rate of 88% has been instrumental in boosting consumer confidence.

However, the situation remains fluid, as the emergence of the Omicron variant has led Singapore and Thailand to tighten quarantine-free travel. Elsewhere, some territories have reinstated mobility restrictions.

Let’s take a deeper dive into various dynamics for AP REITs:

Even in 2020, when the impact of COVID was at its greatest, the dividend returns from REITs were still positive. This was primarily underpinned by office and industrial REITs that enjoyed high rental- collection rates.

Chart 1: Asia REITs (ex-Japan) outperformed broad market and real-estate stocks in 2021 with lower volatility (Index level rebased at 100)

Source: Bloomberg, as of 29 December 2021. Asia REITs represented by FTSE/EPRA Nareit Asia ex-Japan index (capped); Asia equities represented by MSCI Asia ex-Japan index; Asia real-estate stocks represented by MSCI Asia ex-Japan real-estate index.

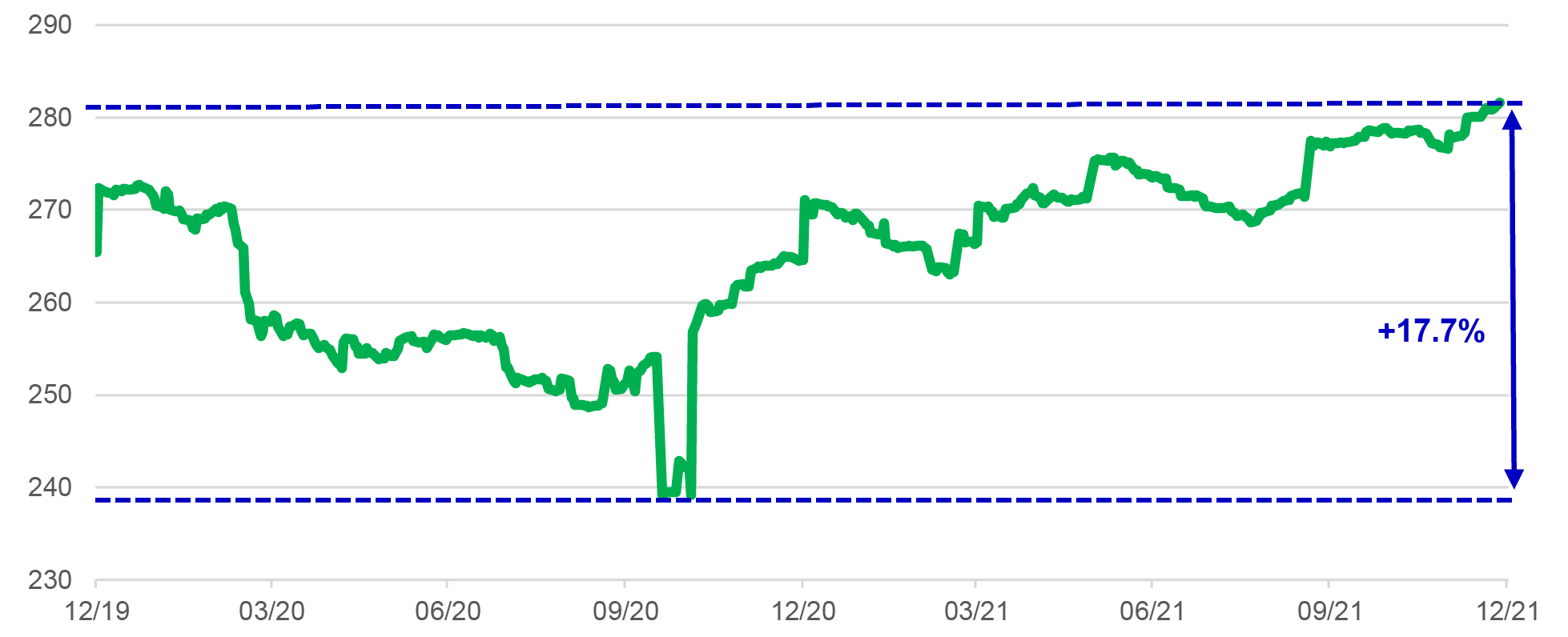

Overall, we saw 2021 as a recovery year for dividends. This is likely to continue going into 2022, as rental holidays end, occupancy rates improve augmented with full year dividend contribution from new acquisitions done in 2021. For 2021 dividend estimates, it has recovered by 24% from the low point in October 2020. And for 2022, estimates for the same period have recovered by 17-18%; both are above the highs seen at the beginning of 2020 (see Chart 2).

As we look ahead to 2022, there are several reasons to be optimistic about the global recovery.

With higher global vaccination rates, the economic risk of the pandemic is likely to fade. However, this will depend on the trajectory of the Omicron variant. Compared to a year ago, governments now have more solutions to help fight the pandemic, such as booster rollouts and effective anti-viral drugs.

Key markets, like Singapore and Australia, have achieved high vaccination rates and began reopening borders in the fourth quarter of 2021.

Yet, the Hong Kong vaccination rate remains comparatively low (especially among the elderly), and the city isn’t expected to relax its border controls until 2022.

As more territories accept COVID-19 as endemic, there should be an end to disruptive lockdowns or tightening. Consequently, rental support and relief may be considerably lower year-on-year.

Despite COVID-related disruptions in 2021, we continue to see healthy transactions in Asia’s commercial real estate market that will support capital values. 2022 may be a year when we see a more globally synchronised re-opening of borders, with the most tightly controlled, China, looking at a potential border reopening in 2022. We believe there will be greater confidence regarding travel and the resumption of cross-border business activities like leasing negotiations and due diligence on asset acquisitions.

Of course, this assumes no further deterioration in the COVID-19 situation.

Chart 2: Asia REITs (ex-Japan) dividend recovery poised to continue in 2022 (index dividend value)

Source: Bloomberg, as of 29 December 2021. Asia REITs represented by FTSE/EPRA Nareit Asia ex-Japan index (capped); Asia equities represented by MSCI Asia ex-Japan Index; Asia real-estate stocks represented by MSCI Asia ex-Japan real-estate index.

Healthy demand in the industrial and warehousing sector should continue. This has already reduced vacancy rates in major markets to low levels. The strong rental growth trend could be an additional performance driver.

Reopening plays remain attractive, as we anticipate a synchronised loosening of global borders. In particular, city and discretionary malls are operating below pre-COVID levels due to the work-from-home trend and limited leisure travel. As such, they can offer more recovery upside in 2022.

In mid-2021, global inflationary pressures began to build. As a result, we saw heightened volatility in the share prices of REITs due to stagflation fears. Recent inflationary data has been robust due to higher oil prices, supply-chain disruptions and a strong recovery in demand. However, in recent weeks, central banks like the Bank of England have increased interest rates, and the US Federal Reserve (Fed) has signalled the potential for up to three rate hikes in 2022. Our forecast is still on the dovish side, even though we’ve pulled forward our expectation of rate hikes: we have two rate hikes pencilled in for the second half of 2022.

Over the long-term, our house view has not changed: we think that interest rates should remain lower for longer. Low rates have been supportive for real estate, given the comfortable income pick-up buffer over the cost of borrowing. It has also helped REITs make accretive acquisitions as debt has remained affordable.

We think that every tapering exercise is different, and the market’s reaction this time will not be the same as before. To put things in perspective, the Fed cut rates to zero and aggressively expanded its balance sheet in response to the COVID-19 pandemic. The US economy is recovering strongly as the country re-opens, so it makes sense to reduce quantitative easing. In this cycle, the Fed’s messaging has been more transparent than in the 2013 ‘taper tantrum’ episode and it appears that the market has priced in a lot of the Fed hawkishness into 2022.

We continue to focus on the fundamentals of REITs, such as core earnings and cashflow resilience, strong capital management, and quality real estate to command better rental rates in times of economic recovery.

AP-REITs are poised for a continued rebound in 2022 on the back of gradual economic reopening and recovery in dividends. While the recent emergence of the Omicron variant may introduce greater uncertainty, the resilient fundamentals of the asset class should continue to propel it in the new year.

1 Bloomberg, as of 30 November 2021, Asia ex-Japan REITs is represented by FTSE EPRA/NAREIT Asia ex-Japan REITs Index. Performance in US dollar.

2024 Outlook Series: Global Healthcare Equities

2023 was a tumultuous year for equity markets and the healthcare sector. For 2024, we maintain a sense of considerable optimism for the performance of healthcare equities and the underlying key subsector themes.

Asset allocation outlook: proceed with caution

There were a number of key economic and market themes in flux in 2023, most notably a global economic environment that held up stronger than most market participants predicted. As 2024 gets under way, we look at some of the themes driving our asset allocation outlook.

A brighter 2024 outlook for U.S. regional banks as rates and deposit costs change course

With interest rates appearing to have peaked and lenders’ deposit costs easing, 2024 could turn out to be a far more hospitable year for U.S. regional banks than 2023.

2024 Outlook Series: Global Healthcare Equities

2023 was a tumultuous year for equity markets and the healthcare sector. For 2024, we maintain a sense of considerable optimism for the performance of healthcare equities and the underlying key subsector themes.

Asset allocation outlook: proceed with caution

There were a number of key economic and market themes in flux in 2023, most notably a global economic environment that held up stronger than most market participants predicted. As 2024 gets under way, we look at some of the themes driving our asset allocation outlook.

A brighter 2024 outlook for U.S. regional banks as rates and deposit costs change course

With interest rates appearing to have peaked and lenders’ deposit costs easing, 2024 could turn out to be a far more hospitable year for U.S. regional banks than 2023.